Trustee Payment

What is Trustee Payment

%URL% and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank, B2B, B2C and C2B account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Trustee Payment for your business using Real-Time Payments

To manage trustee payments from a trustee to beneficiaries using Real-Time Payments (RTP) and FedNow through an escrow and Client Trust Account (CTA), and integrate these transactions into QuickBooks Online (QBO) or QuickBooks Enterprise via Real-TimePayments.com, follow these steps:

Step 1: Set Up Accounts

- Client Trust Account (CTA): Ensure the trustee has a properly set up CTA for holding and managing funds on behalf of beneficiaries.

- Escrow Account: Establish an escrow account to temporarily hold funds before they are distributed to beneficiaries.

- Beneficiary Accounts: Ensure all beneficiaries have bank accounts that can receive RTP and FedNow payments.

Step 2: Set Up Real-TimePayments.com Account

- Visit Real-TimePayments.com: Go to Real-TimePayments.com and create an account for the trustee if not already done.

- API Access: Obtain API credentials from Real-TimePayments.com for integrating RTP and FedNow services.

Step 3: Integrate Real-Time Payments with QuickBooks

- Install Plugin: Download and install any necessary plugins or add-ons for integrating Real-TimePayments.com with QuickBooks Enterprise or QBO.

- API Integration: Configure the integration with the API credentials obtained from Real-TimePayments.com to enable RTP and FedNow payments.

Step 4: Trustee Transfers Funds to Escrow

Using Real-TimePayments.com

- Log In: Access the trustee’s Real-TimePayments.com account.

- Initiate Transfer to Escrow:

- Navigate to the “Send Payment” section.

- Fill in the required details:

- From Account: Trustee’s CTA details.

- To Account: Escrow account details.

- Amount: Payment amount.

- Currency: USD.

- Reference Information: Details like “Transfer to Escrow for Beneficiary Distribution”.

Example API Request to Transfer to Escrow

json code

{

"fromAccount": {

"bankId": "87654321",

"accountNumber": "0123456789"

},

"toAccount": {

"bankId": "12345678",

"accountNumber": "9876543210"

},

"amount": "1000.00",

"currency": "USD",

"referenceInformation": "Transfer to Escrow for Beneficiary Distribution"

}

- Confirm and Send: Review and confirm the transfer.

Step 5: Distribute Funds to Beneficiaries from Escrow

- Access Escrow Account: Trustee accesses the escrow account via Real-TimePayments.com.

- Initiate Payments to

Beneficiaries:

- For each beneficiary, fill in

the payment details:

- From Account: Escrow account details.

- To Account: Beneficiary’s bank account details.

- Amount: Payment amount.

- Currency: USD.

- Reference Information: Details like “Trustee Payment to Beneficiary”.

- For each beneficiary, fill in

the payment details:

Example API Request to Pay Beneficiary

json code

{

"fromAccount": {

"bankId": "12345678",

"accountNumber": "9876543210"

},

"toAccount": {

"bankId": "23456789",

"accountNumber": "0123456789"

},

"amount": "500.00",

"currency": "USD",

"referenceInformation": "Trustee Payment to Beneficiary"

}

- Confirm and Send: Review and confirm each payment.

Step 6: Sync Transactions with QuickBooks

- Automatic Sync: Ensure the Real-TimePayments.com integration is configured to automatically sync transactions with your QuickBooks Enterprise or QBO account.

- Manual Sync: If needed, manually sync transactions by navigating to the sync option within the integration settings.

Step 7: Verify Transactions in QuickBooks

- QuickBooks Enterprise:

- Open QuickBooks Enterprise.

- Navigate to the relevant accounts and verify the sent and received transactions.

- QuickBooks Online:

- Log in to your QBO account.

- Check the transaction history and account statements for the FedNow payments.

Step 8: Security Best Practices

- Secure API Keys: Keep your API keys and credentials secure.

- Two-Factor Authentication: Enable two-factor authentication on all relevant accounts.

- Regular Monitoring: Regularly monitor account activities for any unauthorized transactions.

- Software Updates: Keep your QuickBooks and Real-TimePayments.com integration updated to the latest versions.

Conclusion

By following these steps, trustees can efficiently manage and distribute funds using RTP and FedNow via Real-TimePayments.com, and ensure seamless integration with QuickBooks Enterprise or QBO. Regular verification and secure practices are essential to maintain the integrity and security of the transactions.

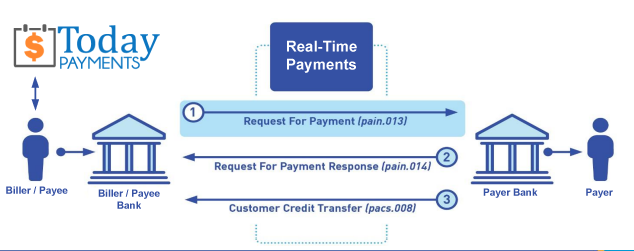

Creation Request for Payment Bank File

Call us, the .csv and or .xml Real-Time Payments (RTP) or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing